This week, Google announced a significant update to Google Shopping, making it free for all merchants to sell their products. Although this will initially only take effect in the U.S. (before the end of April), Google aims to expand this globally by the end of the year.

This will undoubtedly shake up the landscape, allowing smaller brands to soon be much more competitive, so Koozai has taken a look at how this can impact small to large businesses across SEO and Paid channels…

What’s the impact on SEO?

Whilst we don’t definitively know yet how this will take shape, it seems clear that Google will now be splitting all shopping ads across paid and organic, promoting paid ads at the top and bottom of the screen in the new Google Shopping browser window. This will still give those brands investing significant budget a good advantage, however smaller brands can now compete organically where previously they may have not been able to do so.

This will naturally have a huge impact on organic traffic, as we could now be seeing the referral of this traffic come from Google Shopping, however we don’t yet know how this will be attributed in Google Analytics or via the Google Merchant Centre.

Users will be driven by purchase intent more than ever, and we predict there’ll be a huge shift in users clicking on organic results under ‘all’ listings as they move over to ‘shopping’. Perhaps this may mean that ‘all’ listings need to sell a product or page more from a content engagement perspective, letting the meta description and titles aid a purchase decision, whilst Google Shopping will convert? Although we don’t know for sure at this stage, we expect this could have an impact on the digital purchase journey.

It’s also important to note that the market place will become more crowded, so users will need to be engaged instantly to stay on-site. The consequence of this is consumers will know they can go back to Google Shopping and find a different site, advertising the same product, for the same price. Therefore, it will be key to support product pages with effective buying guides, information and USPs selling the brand/company, all to prevent those users from bouncing off-site.

Some good news for SEOs and businesses

The immediate upside of this for SEO practitioners is the availability of a whole lot more real estate from which to generate traffic.

SEOs have long been complaining about the erosion of organic real estate over time; the slow evolution of paid ads to look less ‘ad-y’, cluttering of SERPs with rich results, increases in Google products (e.g. Jobs, Flights), and the rise of ‘zero click’ searches. So, the introduction of an organic shopping feed will come as real encouragement to businesses that have seen their share of organic traffic squeezed over the last few years.

Of course, this won’t instantly mean more free traffic for everyone; the shopping feed is of course only relevant for businesses selling physical products rather than services. Such a large change also means that competition for space on the organic shopping feed will likely be fierce as businesses rush to optimise their products feeds.

Early Considerations

Many SEOs will be wondering how the shopping feed algorithm differs from the algorithm used to sort the regular web results, if at all. Once this is clearer, it will inform how the shopping feed is optimised, but regardless of how the results are organised, we can envisage that the following will be important considerations for CTR:

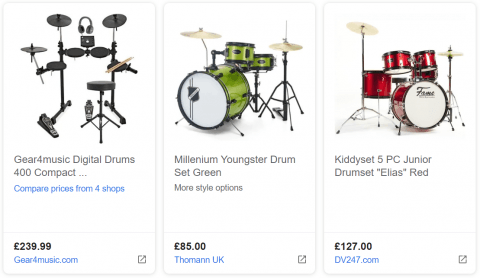

Imagery

The product image is arguably the most impactful and eye-catching aspect of a shopping listing. While SEOs may have only considered image optimisation previously in the context of file names, file size and alt tags, image selection will now have an impact on CTR, meaning that testing will be required to ascertain which images provide the best CTRs.

It may be that images used on pages that perform well on web search don’t perform so well in isolation on the shopping feed. SEOs would do well to consult their Paid team colleagues on image selection to ensure they hit the ground running.

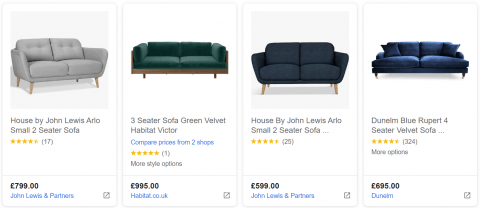

Pricing

Many SEOs will already be aware of the impact of pricing on CTRs through the use of product schema on e-commerce sites. Depending on the industry, the search intent and the competition, showing prices in search results can have either a positive or negative impact on CTRs.

The shopping feed may be different; for paid results prices are mandatory and if the same is true for organic results (which is likely to be the case), then there is less chance to sell the benefits of a product on a landing page – if users don’t like the price they may well not click at all. This means SEOs will need to work more closely with product and pricing teams to ensure that the best and most up to date prices are always being shown.

Product Titles

In web search, SEOs are well aware of the significant impact optimising title tags can have. Again, the same may be true of the shopping feed, but either way titles will be important for CTRs. How many pixels will there be to play with? Should the brand name be included? Will special characters such as exclamation marks be permitted? Those who are going to be make the most of the shopping feed will want to know the answers to these questions as soon as possible.

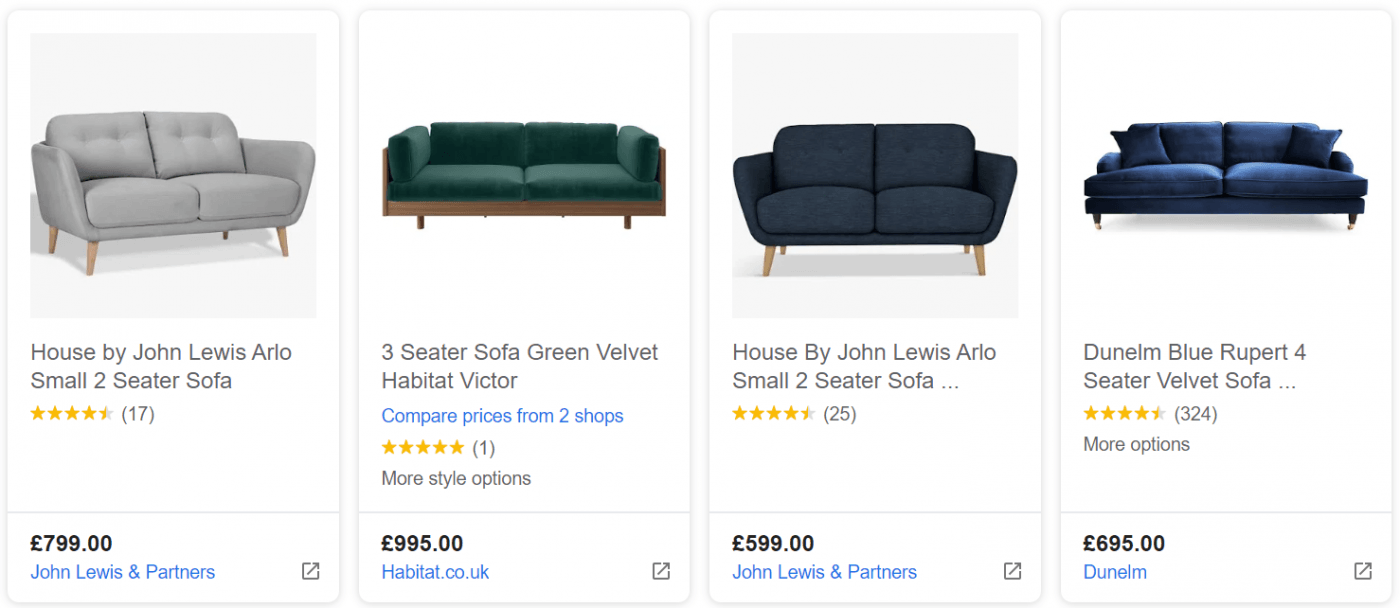

Reviews

Like product schema, review schema can have a big impact on CTRs in web results. A result from a business with lots of good reviews may well trump a result from a business with no reviews (even if it ranks below it). Review scores will likely be of similar importance in the shopping feed, making results more eye-catching and increasing the trust factor. If you think the shopping feed is going to play a part in your strategy going forwards, it might be a good idea to look at your customer reviews strategy too.

What’s the impact on paid media?

This is a massive shift on the Google Shopping tab of the SERP, allowing organic shopping listings to appear to users. However, there won’t be much change on the main Google Search page. The carousel of shopping results that you typically see at the top of the search page will remain (for now) as paid listings. Therefore, in order for your shopping ads to appear alongside search listings, you’ll still need to assign media budget to shopping campaigns. We don’t know if this will change to allow organic listings in this section in the future, but our guess would be that it won’t. However, this raises another question about the default Google results page that will be used in the future. Could we see Google shift to a product-led strategy like Amazon (pictured below), where the shopping page is the default results page?

This shift now allows paid and organic listings to appear together on the shopping results, much like the traditional search results page. Paid ads will still appear at the top and bottom of the shopping tab with organic listings making up the mid-section. This, of course, gives smaller brands the chance to gain additional organic traffic from the shopping tab for relevant searches, however, in order to maximise visibility on those product-led searches, media budget may be needed. We believe that it may entice more businesses to think about advertising on Google Shopping, as they may not be achieving the visibility from the organic listings alone, and these products need budget behind them. This has certainly been and continues to be the case with Amazon Sponsored Products.

If you’re currently advertising on Google Shopping, no action is needed. Your Merchant Centre is set up and you’ll be able to benefit from the organic listings. If you’re not currently advertising on Google Shopping, we highly recommend setting up a Google Merchant Centre and a feed to start benefitting from the organic listings. The level of urgency around this is unclear, however, as previously mentioned, Google are looking to roll this out globally before the end of the year, but before the end of April in the US.

To summarise, if you’re currently a Google Shopping advertiser, there aren’t any real changes to make. Of course, we’ll need to assess any impact the organic listings have on the usual metrics and if more organic feed optimisation improves the visibility of your ads. If you’re not advertising on Google Shopping and you are eligible to do so, we’d propose setting up a Merchant Centre and uploading a product feed to benefit from organic listings. Advertisers outside of the US have some time to prepare for this though, as it’s expected to be rolled out by the end of 2020.

If you have any thoughts on how this could impact your business or you would like some support, please reach out to the Koozai team and we would be happy to help.

Leave a Reply